Our blog posts may include affiliate links. These affiliate links don't cost you anything, but we might earn a few Euros if you decide to purchase something from one of our recommended website partners. Thank you for your support to help keep this platform up and running!

Hey, all you freelancers out there! If you’re not registered as a Kleinunternehmer, then chances are you’re required in Germany, by law, to submit your VAT taxes monthly (or perhaps quarterly or semi-annually by now).

In my case, I was required for the first two years of registering as a freelancer to submit my VAT taxes to the Finanzamt Düsseldorf on a monthly basis.

At first, this drove me absolutely bonkers! Let me be the first one to say that things are a lot easier as a freelancer when working in Canada. But, I’m not in Canada anymore… so it was essential that I buckled down and figured out how it all worked here in Germany before getting started.

If I’ve caught you completely off guard and you’re thinking ‘woah… woah… woah, Jenna! VAT what now?!‘ then you might want to start off by reading our Ultimate Tax Guide for Freelance Expats in Germany first.

What you need to consider before filing VAT taxes

It is also a good idea that before you venture off on your own, you’re fully comfortable with the German tax system. If you’re not, hire a tax advisor to give you some tips, or pay them to help navigate you through filing your taxes online yourself. Things you might need to consider before filing your own VAT taxes could include:

- How do I claim a large expense (like a car) as a business expense?

- How do I claim foreign earnings?

- Do I claim 7% or 19% VAT or 0% VAT?

- What is a 1% ruling?

- How do I calculate the depreciation of my long-term assets?

- What do I need to know before claiming business lunches?

These are all topics that a tax advisor can help you with. Of course, hiring an accountant to submit your monthly VAT tax to the Finanzamt for you is also a great idea, but only if you have the money. I decided to take this route for the first year of business simply because it was all a little too overwhelming to figure out on top of all the new apartment bills and relocation paperwork I was still learning how to fill out.

Save your hard-earned Euros and file your VAT yourself!

But, as time went on I realized it was time to fend for myself and go off on my own (and save a bunch of money). Hiring a tax advisor to do it for me had set me back over 1,500 EUR for the year when I could have been spending 1 hour a month doing it myself on a program I just learned about (a year too late) called lexoffice.de (and paying less than 100 EUR a year).

The program is in German, but trust me, it’s okay

I have to warn you now, this is an accounting program run completely in the German language. Yes, this makes things a little bit tricky, but once you start to Google translate the words as you browse around, you’ll notice it becomes quite easy, quite quickly. And, who knows!? Perhaps they will come out with an English version in the next little while too!

So, while you might be thinking I’m crazy for sending you to a German website, just take a breather and stay with me here. I used to use a free program called Waveapps which allowed me to create pretty invoices, connect all my credit cards and bank accounts (to manage how much money was coming in and coming out), and also allowed me to send follow-up notices for clients who haven’t paid. It was great, I loved it… which is why it took me so long to make the switch in the first place.

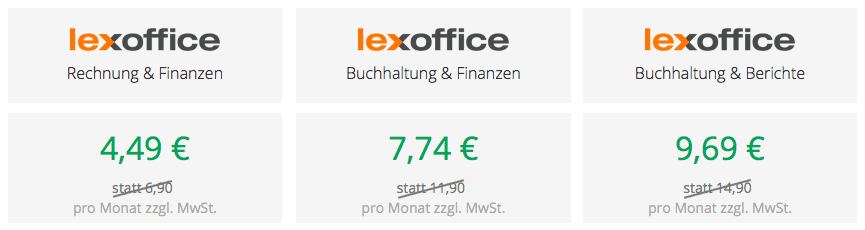

What Waveapps didn’t have was the ability to do all that, plus submit your monthly VAT taxes directly to the Finanzamt through a partnership with ELSTER (an electronic tax declaration issued by the Finanzamt). It also didn’t allow me to submit my annual taxes in Germany directly through the platform, all of which lexoffice does offer. lexoffice offers 3 packages, and while sadly all 3 do cost money, they cost a lot less than hiring an accountant to do the work for you.

*Screenshot was taken from lexoffice.de (note: these sale prices aren’t always around, they just happened to be when I captured the screenshot)

Which package should you choose?

I had originally purchased the Rechnung & Finanzen package thinking ‘if the only difference is a few little perks, why spend the extra money?’ I was wrong. A couple of hours later I ended up having to request a refund in order to get the sale price for the Buchhaltung & Finanzen package. Why? Well… the Buchhaltung & Finanzen package is the package you’re going to need if you want to:

- Keep track of your monthly accounting

- Pay cash for items and include them in your cash book (this also needs to be submitted to the Finanzamt)

- Submit your monthly/quarterly/semi-annually/annually VAT taxes via ELSTER

- Receive VAT taxes back for expenses that can only be paid back over a certain number of years (laptops, cell phones, etc.)

If you’re not going to purchase the second package, I wouldn’t bother purchasing lexoffice at all, instead, just go with free software that offers pretty invoice creation and monthly accounting.

I’ve been using lexoffice for 7 months now and have been nothing but impressed with the ease of submitting my VAT taxes and managing all my invoices, expenses, etc. However, I haven’t yet had the chance to figure out the benefits of the Buchhaltung & Berichte package, but I think this package might be more geared to companies making a little bit more money with their business than I do (I will edit this post when I do have a chance to translate it all).

If you do decide to start up with lexoffice and have any questions at all, feel free to send me an email. I know it’s not easy to figure out all this German accounting stuff at first, but I can try and help you with any questions you might have to get you started!

New to Germany? Join our Welcome Program! Want to join our author team? Send us an email! Join our Life in Düsseldorf | Expats & Locals Community group and register for our newsletter (packed with the hottest events, seasonal activities, upcoming job opportunities and more)!

Can you please confirm that for monthly payment without help of a software we need to fill umsatzsteuervoranmeldung form on elster? I was confused as the form doesnt ask for VAT number, only the steurnummer.

Hi there Ajeesh,

Yes – you need to fill out that form on Elster. ?

You don’t need a VAT number, your steuernummer will work too (I also don’t have a VAT number, but do claim/pay VAT).

Hope this helps a bit!

Cheers,

Jenna

Hello Jenny,

Thank you for the informative post. I am in the middle of unshackling myself from my Steuerberater – it seems to me he is getting paid a lot of money for doing very little. Do you have any more insight on the third option you listed above?

Many thanks,

Joe

Hey there Joe,

Ahhhh, I also had that problem earlier on too. I do really suggest using LexOffice … IF you’re willing to take the time to train yourself to understand the system (even in German). It saved me hundreds (now thousands) of Euros on accounting fees – and I found that it was quite easy (actually easier) to do it myself. I’m a journalist, so it might differ depending on what job field you’re in, but generally using LexOffice is much easier. Since I no longer have to pay monthly VAT, I’ve switched back to a less expensive accountant who just does my VAT at the end of every year.

Thanks again for the insight, Jenna! Very helpful 🙂